Understanding The Backbone Of A Business: Delving Into Fixed Assets

Understanding the Backbone of a Business: Delving into Fixed Assets

Related Articles: Understanding the Backbone of a Business: Delving into Fixed Assets

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Backbone of a Business: Delving into Fixed Assets. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Backbone of a Business: Delving into Fixed Assets

In the intricate world of finance and business, assets play a pivotal role in defining the financial health and operational capabilities of an organization. Among these assets, a distinct category stands out – fixed assets. These are tangible, long-term resources that form the foundation of a company’s infrastructure and operational capabilities, contributing to its long-term value creation and profitability.

This comprehensive guide aims to provide a thorough understanding of fixed assets, their significance in the business world, and their impact on financial reporting and decision-making.

Defining Fixed Assets: A Foundation of Operations

Fixed assets are tangible, long-lived resources that a business owns and uses in its operations. They are not intended for resale but rather for generating revenue and facilitating the company’s core activities. These assets are characterized by their durability, substantial value, and long-term usage, typically exceeding one year.

Key Characteristics of Fixed Assets:

- Tangible: Fixed assets are physical, meaning they have a material presence. This distinguishes them from intangible assets like patents or trademarks.

- Long-Lived: These assets are expected to be used for an extended period, typically exceeding one year. This contrasts with short-term assets like inventory, which are meant for immediate sale.

- Used in Operations: Fixed assets are essential to the company’s daily operations. They are not held for resale but rather used to generate revenue or support the production process.

- Significant Value: Fixed assets represent a substantial investment for the company. Their acquisition and maintenance require considerable capital expenditure.

Examples of Fixed Assets:

- Property, Plant, and Equipment (PP&E): This category encompasses land, buildings, machinery, equipment, vehicles, and other physical assets used in the production process or for administrative purposes.

- Furniture and Fixtures: Office furniture, computers, and other equipment used in the day-to-day operations of the business.

- Leasehold Improvements: Modifications made to leased property to suit the company’s needs, enhancing its functionality and value.

- Intangible Assets with Physical Form: While intangible assets are typically not considered fixed assets, certain intangible assets with a physical form, such as software, can be classified as fixed assets.

The Significance of Fixed Assets:

Fixed assets are the cornerstone of a company’s operational capacity and long-term value creation. Their importance is multifaceted, encompassing:

- Revenue Generation: Fixed assets are essential for producing goods or services, directly contributing to the company’s revenue streams.

- Operational Efficiency: Efficient and well-maintained fixed assets enhance operational efficiency, leading to increased productivity and reduced costs.

- Competitive Advantage: Investing in modern and advanced fixed assets can provide a competitive advantage, enabling the company to produce higher-quality products or deliver more efficient services.

- Long-Term Value: Fixed assets represent a significant portion of a company’s total assets, contributing to its overall value and stability.

- Collateral for Financing: Fixed assets can serve as collateral for loans and other forms of financing, providing access to capital for growth and expansion.

Accounting for Fixed Assets: A Vital Component of Financial Reporting

Fixed assets are subject to specific accounting principles and procedures, ensuring accurate financial reporting and transparency. Key considerations include:

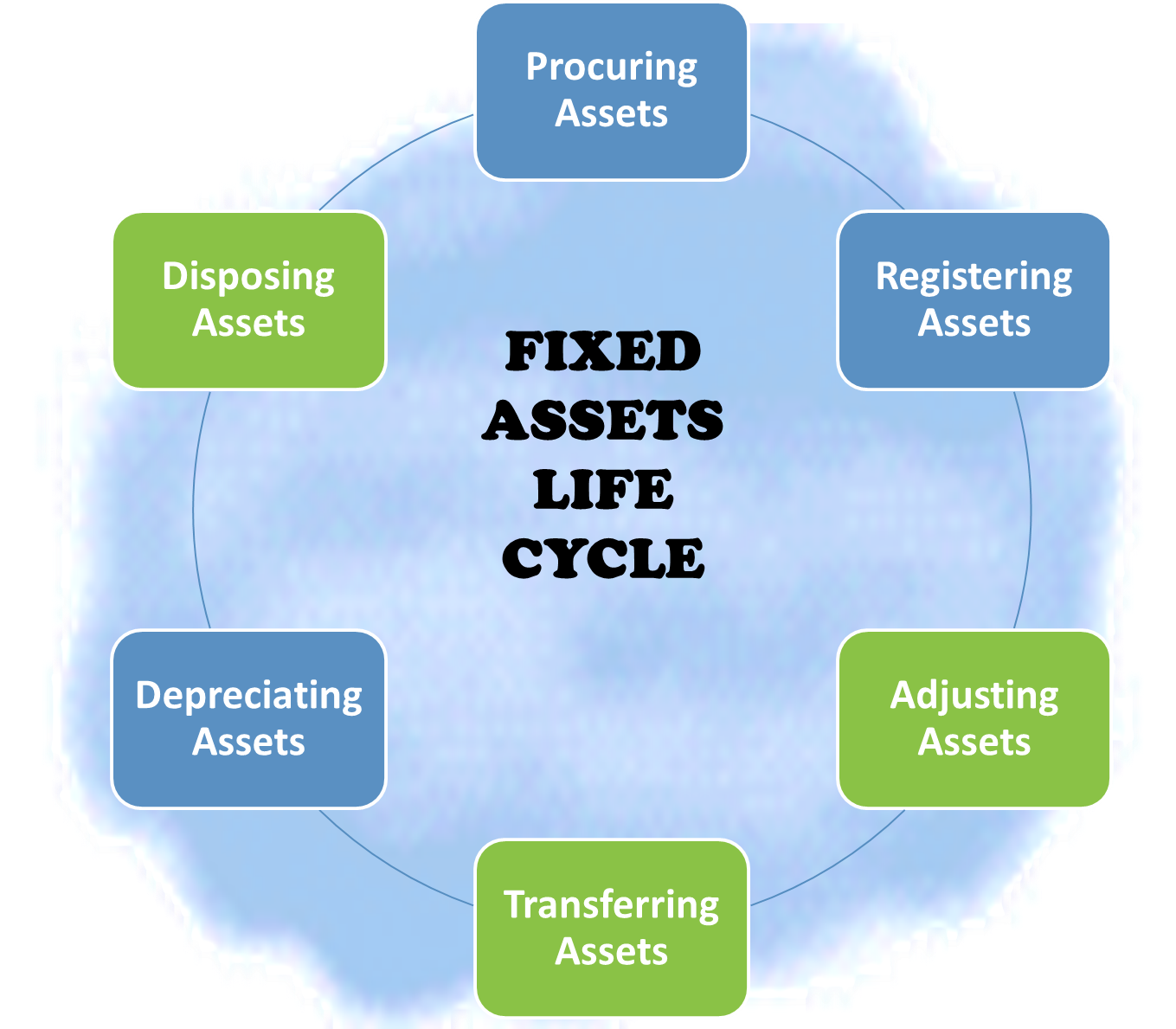

- Initial Recognition: Fixed assets are recorded at their cost, which includes the purchase price, transportation costs, installation expenses, and any other costs incurred to bring the asset into operational condition.

- Depreciation: Fixed assets have a limited useful life and gradually lose their value over time. This decline in value is recognized through depreciation, a systematic allocation of the asset’s cost over its useful life.

- Impairment: If the fair value of a fixed asset falls below its carrying amount, the asset is considered impaired. This requires an adjustment to the asset’s value, reflecting the decline in its economic value.

- Disposal: When a fixed asset is sold or retired, the company must recognize any gain or loss resulting from the transaction.

The Impact of Fixed Assets on Business Decisions:

Understanding fixed assets is crucial for informed business decision-making. These assets influence strategic choices regarding:

- Investment Decisions: The acquisition of fixed assets requires significant capital expenditure. Companies must carefully evaluate potential investments, considering the asset’s expected return on investment, its impact on operational efficiency, and its alignment with the company’s long-term strategic goals.

- Financing Strategies: Financing the acquisition of fixed assets requires careful planning. Companies may choose to utilize debt financing, equity financing, or a combination of both, depending on their financial position and risk tolerance.

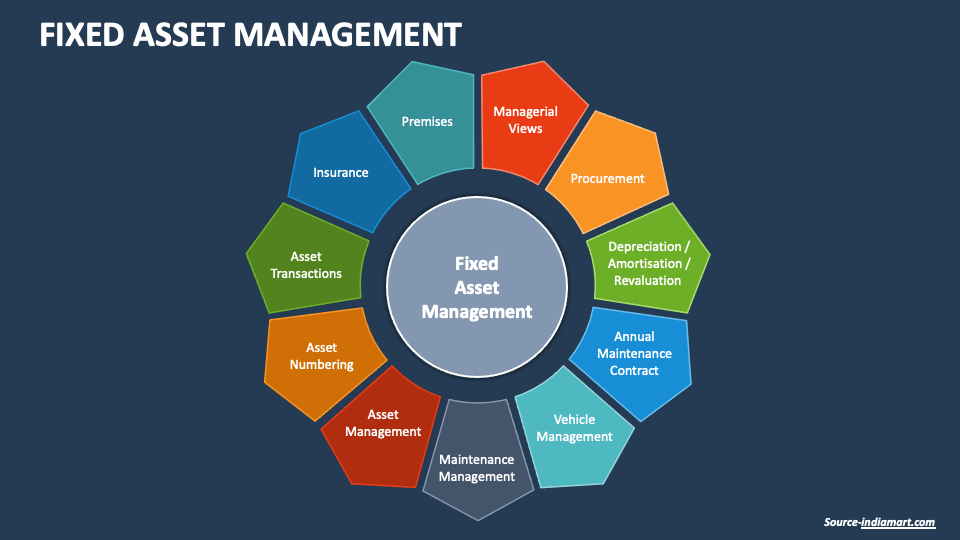

- Operational Management: Effective management of fixed assets is essential for maximizing their value and minimizing costs. This includes implementing maintenance schedules, monitoring asset performance, and optimizing asset utilization.

- Tax Planning: Depreciation and other accounting treatments related to fixed assets have tax implications. Companies must understand these implications and optimize their tax strategies to minimize their tax liabilities.

FAQs on Fixed Assets:

1. What is the difference between a fixed asset and a current asset?

Fixed assets are long-term, tangible resources used in operations, while current assets are short-term assets expected to be converted into cash within a year. Examples of current assets include cash, accounts receivable, and inventory.

2. Why is it important to depreciate fixed assets?

Depreciation recognizes the gradual decline in the value of a fixed asset over its useful life. It ensures that the asset’s cost is systematically allocated to the periods in which it generates revenue, providing a more accurate reflection of the company’s financial performance.

3. How do I determine the useful life of a fixed asset?

The useful life of a fixed asset is the estimated period over which it will be used in the company’s operations. This determination depends on factors such as the asset’s physical condition, expected technological advancements, and the company’s specific usage patterns.

4. What is an impairment charge, and when is it necessary?

An impairment charge is a reduction in the carrying amount of a fixed asset when its fair value falls below its book value. This charge reflects the decline in the asset’s economic value and is necessary to ensure accurate financial reporting.

5. How do I dispose of a fixed asset?

When a fixed asset is sold or retired, the company must remove it from its books and recognize any gain or loss resulting from the transaction. The gain or loss is calculated as the difference between the asset’s carrying amount and the proceeds from its disposal.

Tips for Effective Fixed Asset Management:

- Implement a comprehensive fixed asset register: Maintain a detailed record of all fixed assets, including their acquisition date, cost, depreciation schedule, and location.

- Establish clear asset management policies: Define procedures for asset acquisition, disposal, and maintenance, ensuring consistency and accountability.

- Conduct regular asset audits: Periodically review fixed assets to verify their existence, condition, and value, ensuring accurate accounting and asset tracking.

- Utilize technology for asset management: Implement software solutions to automate asset tracking, depreciation calculations, and other asset management tasks, improving efficiency and reducing errors.

- Develop a proactive maintenance plan: Schedule regular maintenance and repairs to minimize downtime, extend asset life, and reduce unexpected costs.

Conclusion: The Enduring Importance of Fixed Assets

Fixed assets are the backbone of a company’s operations, contributing to revenue generation, operational efficiency, and long-term value creation. Understanding their characteristics, accounting treatment, and impact on business decisions is essential for successful financial management and strategic planning. By effectively managing fixed assets, companies can optimize their financial performance, enhance their competitive advantage, and ensure sustainable growth in the long run.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Backbone of a Business: Delving into Fixed Assets. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- The Enduring Appeal Of XP Jewelry: A Timeless Symbol Of Achievement

- A Global Tapestry Of Adornment: Exploring World Collections Of Jewelry

- The Evolution Of A Brand: Understanding The Name Change Of Lola Rose Jewellery

- Navigating The UK’s Jewelry Wholesale Landscape: A Comprehensive Guide

- The Allure Of Effy Jewelry: Unveiling The Reasons Behind Its Premium Pricing

- The Enduring Appeal Of Gold Jewelry: A Timeless Investment

- The Art Of Harmony: Elevating Your Style Through Accessory Coordination

- The Comprehensive Guide To Wholesale Jewelry Supplies Catalogs: A Treasure Trove For Jewelry Makers And Businesses

Leave a Reply