Navigating The Golden Path: A Guide To Investing In Gold Jewelry

Navigating the Golden Path: A Guide to Investing in Gold Jewelry

Related Articles: Navigating the Golden Path: A Guide to Investing in Gold Jewelry

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Golden Path: A Guide to Investing in Gold Jewelry. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Golden Path: A Guide to Investing in Gold Jewelry

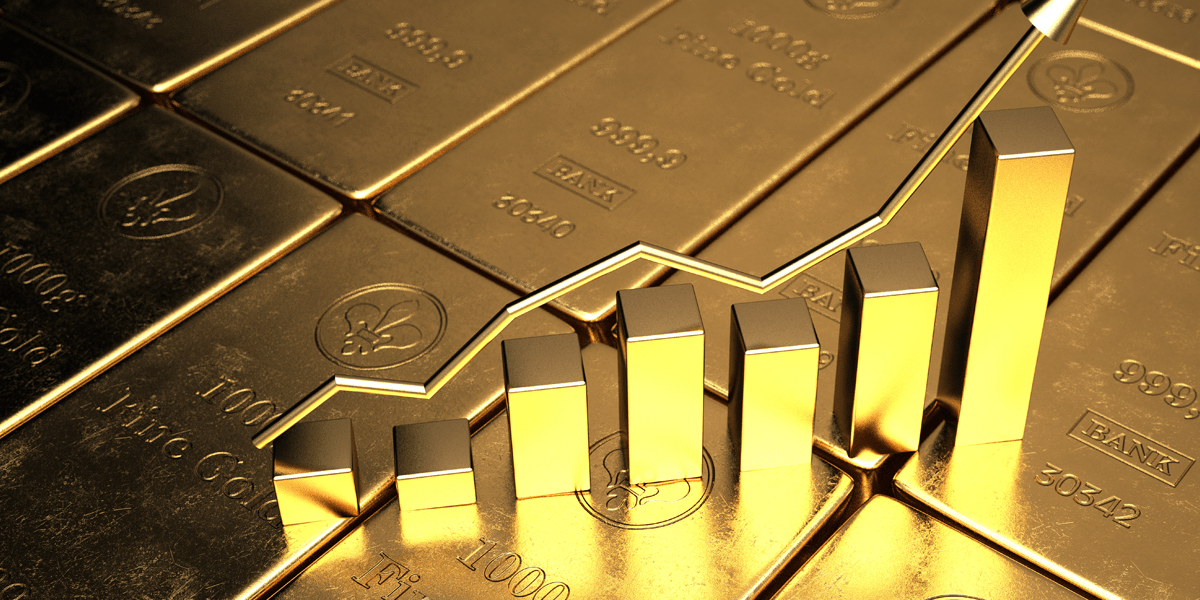

Gold, a precious metal that has captivated humanity for millennia, transcends its role as mere adornment. Its inherent value, coupled with its enduring appeal, positions it as a reliable investment vehicle. While various forms of gold investment exist, gold jewelry offers a unique blend of tangible asset ownership and aesthetic appeal.

This guide delves into the intricacies of investing in gold jewelry, offering a comprehensive framework for navigating this market and making informed decisions.

Understanding the Appeal of Gold Jewelry as an Investment

Gold jewelry’s appeal as an investment stems from several key factors:

- Intrinsic Value: Gold’s inherent value remains relatively stable, acting as a hedge against inflation and economic uncertainty. Its value is not tied to specific companies or industries, offering a degree of portfolio diversification.

- Liquidity: Gold jewelry can be readily sold, offering a relatively quick return on investment. However, liquidity can vary depending on the piece’s design, craftsmanship, and current market demand.

- Tangibility: Owning gold jewelry provides a tangible asset, offering a sense of security and peace of mind. It serves as a physical representation of wealth and can be passed down through generations.

- Aesthetic Appeal: Gold jewelry holds enduring appeal, transcending trends and time. Its timeless elegance and beauty make it a valuable asset that can be enjoyed for generations.

Factors to Consider When Investing in Gold Jewelry

Selecting the right gold jewelry for investment requires careful consideration of several factors:

- Purity: Gold purity is measured in karats (K), with 24K being the purest form. While 24K gold is highly valuable, its softness makes it unsuitable for everyday wear. 18K gold, a popular choice for jewelry, offers a balance of purity and durability.

- Design and Craftsmanship: Classic, timeless designs hold their value better than trendy pieces. Look for intricate craftsmanship, hallmarks of reputable jewelers, and unique features that enhance the piece’s desirability.

- Weight and Size: Larger, heavier pieces generally command higher prices. However, consider the practicality of owning and storing such pieces.

- Gemstones: The presence of gemstones, particularly diamonds, can significantly increase a piece’s value. Ensure the gemstones are certified and of high quality.

- Provenance: Knowing the history of a piece, including its maker and previous owners, can enhance its value. Seek out antique or vintage jewelry with established provenance.

- Market Demand: Research current market trends and identify pieces with high demand. Consult with reputable jewelers and appraisers for guidance.

- Storage and Insurance: Securely store your gold jewelry to protect it from theft or damage. Obtain adequate insurance coverage to mitigate potential losses.

Types of Gold Jewelry for Investment

While any piece of gold jewelry can hold investment potential, certain types are particularly sought after:

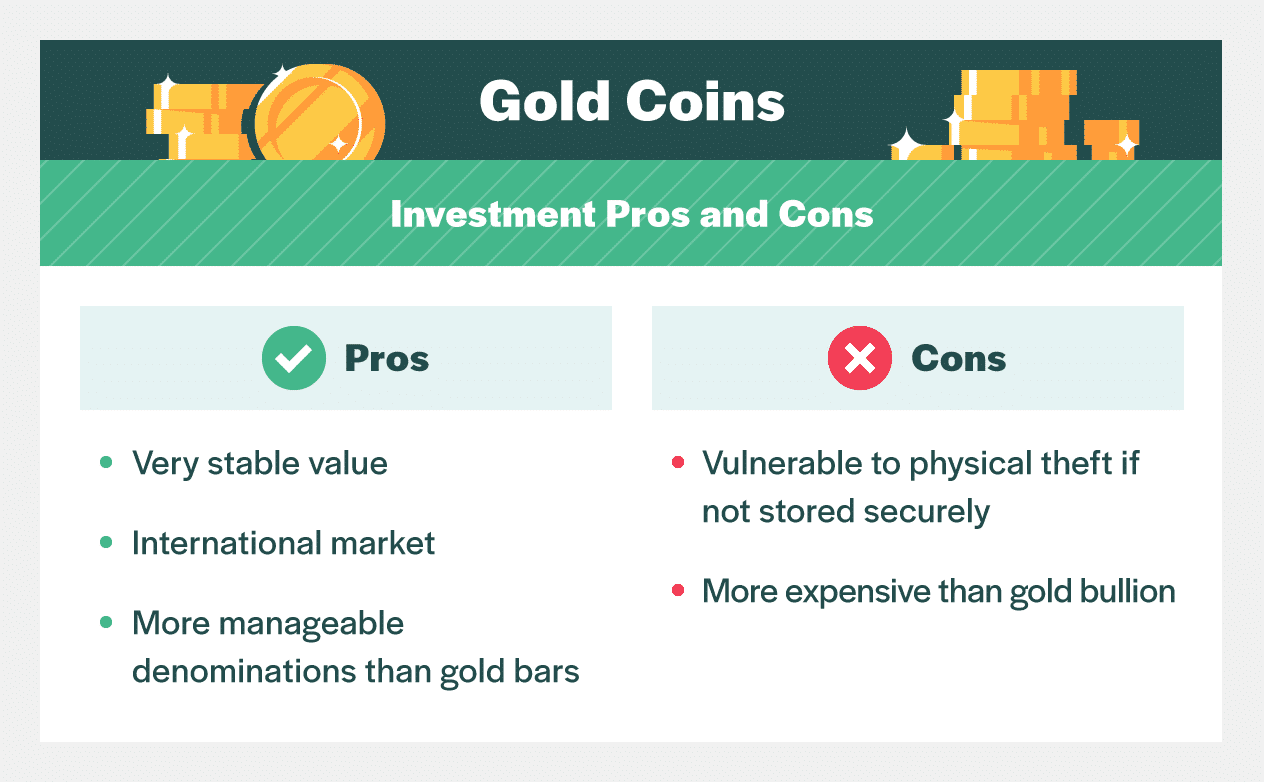

- Coins and Bars: Gold coins and bars are the most common forms of gold investment, offering high purity and ease of trading. However, they lack the aesthetic appeal of jewelry.

- Antique and Vintage Jewelry: Pieces with historical significance, intricate craftsmanship, and unique designs often command premium prices.

- Classic Jewelry: Timeless designs like diamond engagement rings, classic earrings, and pendants retain their value over time.

- Designer Jewelry: Renowned designers’ pieces can appreciate in value due to their exclusivity and craftsmanship.

Tips for Investing in Gold Jewelry

- Buy from Reputable Sources: Ensure you purchase gold jewelry from reputable jewelers or dealers with established track records.

- Seek Professional Advice: Consult with a certified gemologist or appraiser for expert advice on assessing the quality and value of gold jewelry.

- Research Market Trends: Stay informed about market fluctuations and demand for specific types of gold jewelry.

- Diversify Your Portfolio: Don’t put all your investment eggs in one basket. Diversify your portfolio with different types of gold jewelry or other assets.

- Consider Long-Term Investment: Gold jewelry is a long-term investment. Avoid impulsive purchases and focus on pieces with enduring value.

FAQs About Investing in Gold Jewelry

1. How do I determine the value of gold jewelry?

Determining the value of gold jewelry involves considering several factors: purity, weight, design, craftsmanship, gemstones, provenance, and current market demand. A professional appraisal by a certified gemologist or appraiser is essential for accurate valuation.

2. What are the risks associated with investing in gold jewelry?

Like any investment, gold jewelry carries risks. Market fluctuations, theft, damage, and the difficulty in liquidating certain pieces can impact returns.

3. How do I sell gold jewelry?

You can sell gold jewelry through reputable jewelers, pawn shops, or online platforms. However, be aware that you may receive less than the original purchase price due to market fluctuations and fees.

4. How do I store gold jewelry safely?

Store gold jewelry in a secure location, such as a safe deposit box or a home safe. Consider obtaining insurance coverage to protect against theft, damage, or loss.

5. What are the tax implications of selling gold jewelry?

Capital gains tax may be applicable when selling gold jewelry for a profit. Consult with a financial advisor for personalized tax advice.

Conclusion

Investing in gold jewelry offers a unique blend of tangible asset ownership, aesthetic appeal, and potential for appreciation. By understanding the factors influencing gold jewelry’s value, carefully selecting pieces, and implementing sound investment practices, individuals can navigate this market effectively and potentially build a valuable portfolio. Remember that gold jewelry is a long-term investment, requiring patience and a strategic approach for realizing its full potential.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Golden Path: A Guide to Investing in Gold Jewelry. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- The Enduring Appeal Of XP Jewelry: A Timeless Symbol Of Achievement

- A Global Tapestry Of Adornment: Exploring World Collections Of Jewelry

- The Evolution Of A Brand: Understanding The Name Change Of Lola Rose Jewellery

- Navigating The UK’s Jewelry Wholesale Landscape: A Comprehensive Guide

- The Allure Of Effy Jewelry: Unveiling The Reasons Behind Its Premium Pricing

- The Enduring Appeal Of Gold Jewelry: A Timeless Investment

- The Art Of Harmony: Elevating Your Style Through Accessory Coordination

- The Comprehensive Guide To Wholesale Jewelry Supplies Catalogs: A Treasure Trove For Jewelry Makers And Businesses

Leave a Reply