Navigating The Gold Investment Landscape: Finding The Right Monthly Gold Scheme

Navigating the Gold Investment Landscape: Finding the Right Monthly Gold Scheme

Related Articles: Navigating the Gold Investment Landscape: Finding the Right Monthly Gold Scheme

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Gold Investment Landscape: Finding the Right Monthly Gold Scheme. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Gold Investment Landscape: Finding the Right Monthly Gold Scheme

- 2 Introduction

- 3 Navigating the Gold Investment Landscape: Finding the Right Monthly Gold Scheme

- 3.1 Key Factors to Consider When Choosing a Monthly Gold Scheme:

- 3.2 Comparing Popular Monthly Gold Schemes:

- 3.3 FAQs about Monthly Gold Schemes:

- 3.4 Tips for Choosing the Best Monthly Gold Scheme:

- 3.5 Conclusion:

- 4 Closure

Navigating the Gold Investment Landscape: Finding the Right Monthly Gold Scheme

Gold, a timeless symbol of wealth and stability, has long been a popular investment choice. Its inherent value, coupled with its ability to act as a hedge against inflation and economic uncertainty, makes it an attractive asset for individuals seeking to diversify their portfolios and secure their financial future.

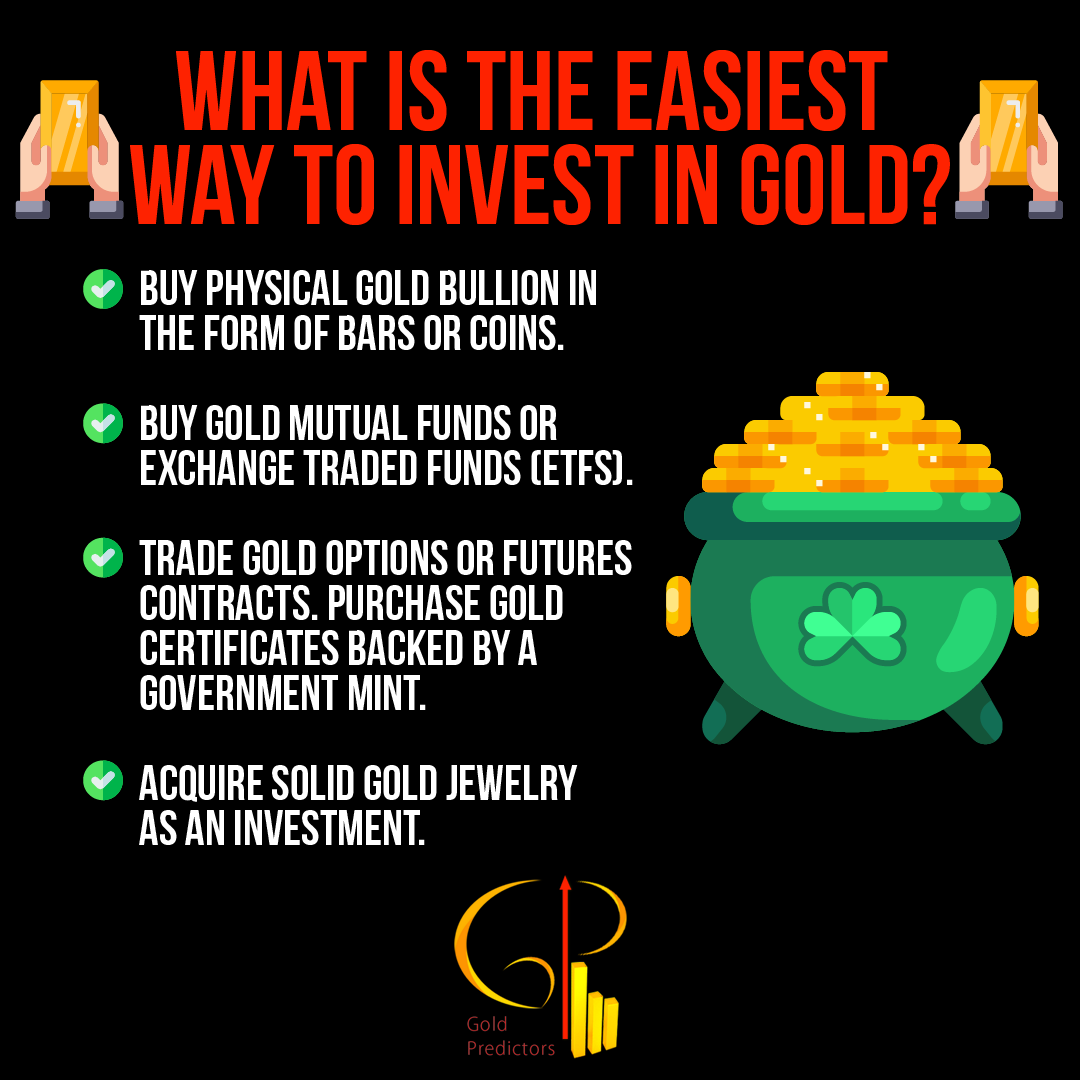

However, the world of gold investment can be complex, with various schemes and options available. One popular approach is the monthly gold scheme, which allows individuals to invest small amounts of money regularly, accumulating gold over time. This strategy offers several advantages, including:

- Accessibility: Monthly schemes make gold investment accessible to individuals with limited capital, enabling them to start building their gold portfolio gradually.

- Regular Savings: The systematic nature of monthly schemes promotes discipline and encourages regular savings, fostering a consistent investment approach.

- Dollar-Cost Averaging: By investing fixed amounts at regular intervals, monthly schemes help mitigate the risk of market volatility, averaging out purchase prices over time.

- Potential for Appreciation: Gold prices tend to appreciate over the long term, making monthly schemes a potentially rewarding investment strategy.

But with numerous monthly gold schemes available, choosing the right one can be daunting. This article aims to provide a comprehensive guide, analyzing key aspects and factors to consider when evaluating different monthly gold schemes.

Key Factors to Consider When Choosing a Monthly Gold Scheme:

- Transparency and Reputation:

- Transparency: The scheme should operate with transparency, clearly outlining its terms and conditions, fees, and investment processes.

- Reputation: Choose a reputable provider with a proven track record and strong customer service. Research their history, financial stability, and customer feedback.

- Investment Options:

- Gold Purity: The scheme should offer gold of high purity, preferably 24K or 999.9 purity, to ensure maximum value.

- Gold Form: Consider the form of gold offered, such as coins, bars, or digital gold. Each form has its advantages and disadvantages, depending on your investment goals and preferences.

- Minimum Investment Amount: Choose a scheme with a minimum investment amount that aligns with your budget and financial goals.

- Fees and Charges:

- Charges: Be aware of all fees associated with the scheme, including management fees, storage fees, and transaction fees.

- Transparency: Ensure that all fees are clearly stated and explained, avoiding hidden costs or unexpected charges.

- Withdrawal Options:

- Flexibility: The scheme should offer flexible withdrawal options, allowing you to access your gold investment when needed.

- Minimum Withdrawal Amount: Consider the minimum withdrawal amount, ensuring it aligns with your investment strategy.

- Security and Insurance:

- Storage: The scheme should provide secure storage for your gold, either in a vault or through insured digital platforms.

- Insurance: Ensure that your gold investment is adequately insured against theft, damage, or loss.

- Customer Service:

- Responsiveness: The provider should offer responsive and helpful customer service, addressing your inquiries and concerns promptly.

- Accessibility: Ensure that the provider offers convenient communication channels, such as phone, email, or online chat.

Comparing Popular Monthly Gold Schemes:

- Gold Sovereign Bonds (GSB): Issued by the Government of India, GSBs offer a secure and transparent way to invest in gold. They are backed by the government, providing a low-risk investment option.

- Gold ETFs (Exchange Traded Funds): These funds track the price of gold, allowing investors to invest in gold through a diversified portfolio of gold-related assets. They offer liquidity and transparency, making them a popular choice.

- Digital Gold Platforms: These platforms allow investors to purchase and store gold digitally, offering convenience and accessibility. They often offer lower fees compared to traditional gold schemes.

- Gold Savings Schemes by Banks and Financial Institutions: Many banks and financial institutions offer monthly gold savings schemes, allowing customers to invest small amounts of money regularly. These schemes often come with attractive interest rates and other benefits.

FAQs about Monthly Gold Schemes:

Q: How much gold can I buy through a monthly scheme?

A: The amount of gold you can buy depends on the scheme’s minimum investment amount, your budget, and the current gold price.

Q: Is it safe to invest in gold through a monthly scheme?

A: The safety of a monthly gold scheme depends on the provider’s reputation, security measures, and insurance coverage. Choosing a reputable provider with strong security protocols and insurance coverage is crucial.

Q: How can I track the performance of my gold investment?

A: Most monthly gold schemes provide online platforms or statements that allow you to track the performance of your investment.

Q: What are the tax implications of investing in gold through a monthly scheme?

A: The tax implications vary depending on the scheme and the jurisdiction. Consult a financial advisor or tax expert for specific guidance.

Q: Can I withdraw my gold investment before maturity?

A: Most monthly gold schemes offer flexibility in withdrawing your investment, but there may be fees or penalties associated with early withdrawals.

Tips for Choosing the Best Monthly Gold Scheme:

- Define your investment goals: Determine your financial objectives, such as building wealth, diversifying your portfolio, or hedging against inflation.

- Compare different schemes: Research and compare different monthly gold schemes, considering their features, fees, and reputation.

- Read the fine print: Carefully review the terms and conditions of any scheme you are considering, paying attention to fees, charges, and withdrawal options.

- Seek professional advice: Consult a financial advisor for personalized guidance and recommendations based on your financial situation and investment goals.

Conclusion:

Choosing the best monthly gold scheme requires careful consideration of various factors, including transparency, investment options, fees, security, and customer service. By carefully evaluating these aspects and following the tips provided, individuals can make informed decisions and select a scheme that aligns with their investment objectives and financial aspirations. Remember, investing in gold should be a strategic and long-term approach, contributing to a diversified portfolio and a secure financial future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Gold Investment Landscape: Finding the Right Monthly Gold Scheme. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- The Enduring Appeal Of XP Jewelry: A Timeless Symbol Of Achievement

- A Global Tapestry Of Adornment: Exploring World Collections Of Jewelry

- The Evolution Of A Brand: Understanding The Name Change Of Lola Rose Jewellery

- Navigating The UK’s Jewelry Wholesale Landscape: A Comprehensive Guide

- The Allure Of Effy Jewelry: Unveiling The Reasons Behind Its Premium Pricing

- The Enduring Appeal Of Gold Jewelry: A Timeless Investment

- The Art Of Harmony: Elevating Your Style Through Accessory Coordination

- The Comprehensive Guide To Wholesale Jewelry Supplies Catalogs: A Treasure Trove For Jewelry Makers And Businesses

Leave a Reply